Koristite zastareli preglednik. Možda se neće pravilno prikazivati ova ili druge veb stranice.

Trebalo bi da nadogradite ili koristite alternativni preglednik.

Trebalo bi da nadogradite ili koristite alternativni preglednik.

Finansijska tržišta (trgovina akcijama, obveznicama i dr. instrumentima)

- Začetnik teme dragan

- Datum pokretanja

Mikie

Higher intermediate

- Učlanjen(a)

- 26.08.2019.

- Poruke

- 1.828

- Pohvaljen

- 3.862

Amateur short sellers, having made their move too late, quickly follow the professionals’ lead. Floor traders, sensing the reversal, throw the weight of their buying behind the market. Thus, the rally is on. Obviously, such a phenomenon is not a forecast of a fundamental turn but merely a technical rebound in a market that has gone too far too fast.

It is invariably easier to call the end of a bear market rally than the beginning. Rhea described one of the best methods for identifying the top:

‘‘In such action the peak is frequently attained on a sudden increase in activity lasting a few days. It is usually impossible to pick the turn with any degree of precision; however if, after the high point has been attained, a further rally shows a definite diminution in activity, it is probable that an early resumption of the decline will occur.’’

Dullness following the peak of a bear market rally is a common danger sign. However, it is often confused by the average investor who fails to realize that the old adage, ‘‘Never sell a dull market,’’ does not apply when the primary trend is down. Dow was the first to recognize the implications of dullness.

In 1902, he wrote, ‘‘...the action of the market after dullness depends chiefly upon whether a bull or bear market is in progress. In a bull market dullness is generally followed by advances, in a bear market by declines.’’ He adds that, in bear markets, ‘‘...prices fall because values are falling, and dullness merely allows the fall in values to get ahead of the fall in prices.’’

Following a bear market rally, one Average often advances to a new high,but this may not be confirmed by the other Average. In such areas, dullnessoften occurs, after which both Averages sag below preceding decline points,and the primary downtrend is again resumed. Psychology during bear marketrallies seems to follow a fairly consistent pattern.‘‘

During secondary reactions in bear markets,’’ wrote Rhea, ‘‘it is a fairly uniform experience for traders and market experts to become very bullish. They are usually bearish about the time the upturn comes.’’

The converse holds true of the psychology that precedes a bear market rally. Here, boardroom ‘‘oracles’’ are gloomy, investment services are pointing out the advantages of bonds and defensive stocks, and neophytes are trying their hand at shorting. The bad news, which already has been discounted in the downward swing, is appearing on all sides. At such times, a bear rally is in the making.

mega.nz

mega.nz

STAGE 2 BMR TOWN

.

.

40% SP500 ima earnings report ove nedelje...

moji long puts iz januara su samleveni, ali ih i dalje držim... mislim da ce biti nekog minimalnog profita... cash is KING kao i uvek...short the rip strategija najbolje funkcioniše u prvoj i trećoj fazi bear-a

u drugoj fazi bear-a, zakasneli bearovi su pojedeni živi, a onda svi misle da je bull market već počeo, i onda počinje limit down market - programirano je...bukvalno.

u četvrtoj fazi se kupuje decenijsko dno.

mega.nz

mega.nz

Veliko hvala @WifeyAlpha et al... ogroman izvor znanja u poslednjih godinu i po i kusur dana...

It is invariably easier to call the end of a bear market rally than the beginning. Rhea described one of the best methods for identifying the top:

‘‘In such action the peak is frequently attained on a sudden increase in activity lasting a few days. It is usually impossible to pick the turn with any degree of precision; however if, after the high point has been attained, a further rally shows a definite diminution in activity, it is probable that an early resumption of the decline will occur.’’

Dullness following the peak of a bear market rally is a common danger sign. However, it is often confused by the average investor who fails to realize that the old adage, ‘‘Never sell a dull market,’’ does not apply when the primary trend is down. Dow was the first to recognize the implications of dullness.

In 1902, he wrote, ‘‘...the action of the market after dullness depends chiefly upon whether a bull or bear market is in progress. In a bull market dullness is generally followed by advances, in a bear market by declines.’’ He adds that, in bear markets, ‘‘...prices fall because values are falling, and dullness merely allows the fall in values to get ahead of the fall in prices.’’

Following a bear market rally, one Average often advances to a new high,but this may not be confirmed by the other Average. In such areas, dullnessoften occurs, after which both Averages sag below preceding decline points,and the primary downtrend is again resumed. Psychology during bear marketrallies seems to follow a fairly consistent pattern.‘‘

During secondary reactions in bear markets,’’ wrote Rhea, ‘‘it is a fairly uniform experience for traders and market experts to become very bullish. They are usually bearish about the time the upturn comes.’’

The converse holds true of the psychology that precedes a bear market rally. Here, boardroom ‘‘oracles’’ are gloomy, investment services are pointing out the advantages of bonds and defensive stocks, and neophytes are trying their hand at shorting. The bad news, which already has been discounted in the downward swing, is appearing on all sides. At such times, a bear rally is in the making.

File on MEGA

STAGE 2 BMR TOWN

.

.

40% SP500 ima earnings report ove nedelje...

moji long puts iz januara su samleveni, ali ih i dalje držim... mislim da ce biti nekog minimalnog profita... cash is KING kao i uvek...short the rip strategija najbolje funkcioniše u prvoj i trećoj fazi bear-a

u drugoj fazi bear-a, zakasneli bearovi su pojedeni živi, a onda svi misle da je bull market već počeo, i onda počinje limit down market - programirano je...bukvalno.

u četvrtoj fazi se kupuje decenijsko dno.

File on MEGA

Veliko hvala @WifeyAlpha et al... ogroman izvor znanja u poslednjih godinu i po i kusur dana...

Poslednja izmena:

MC_

Professional

- Učlanjen(a)

- 14.11.2017.

- Poruke

- 11.791

- Pohvaljen

- 12.086

Miroslav Parović:

"Prema zvaničnim podacima o broju novoizdatih građevinskih dozvola može se videti da u poslednjih osam meseci postoji značajan pad. Samo u martu mesecu izdato je 10% manje nego u istom periodu prošle godine. Ovo praktično znači da će u 2023. već doći do osetnog i vidiljivog pada građevinskog sektora, a ako se trend pada izdavanja građevinskih dozvola nastavi najkasnije do 2025. godine možemo očekivati potpuni krah pre svega stanogradnje.

Ako dođe do ovakvog scenarija, a sve ukazuje da se ka tome ide, to će značiti značajan pad ukupne privredne aktivnosti i veliki rast nezaposlenosti. Ovo će prvo biti vidljivo van Beograda i Novog Sada (u kojima za sada nema osetnijeg pada građevinskog sektora), ali će se neminovno proširiti i na ova dva glavna ekonomska centra.

U praktičnom smislu to znači da će hiljade ljudi koji sada rade kao zidari, tesari, keramičari, električari ili pomoćni radnici na građevini ostati bez posla. Isto tako, padom građevinskog sektora pada i transport i prodaja građevinskog materijala, smanjuje se proizvodnja i kupovina nameštaja i još mnogo stvari koje su međusobom povezane."

Da li cemo konacno videti kraj investitorske ekonomije?

"Prema zvaničnim podacima o broju novoizdatih građevinskih dozvola može se videti da u poslednjih osam meseci postoji značajan pad. Samo u martu mesecu izdato je 10% manje nego u istom periodu prošle godine. Ovo praktično znači da će u 2023. već doći do osetnog i vidiljivog pada građevinskog sektora, a ako se trend pada izdavanja građevinskih dozvola nastavi najkasnije do 2025. godine možemo očekivati potpuni krah pre svega stanogradnje.

Ako dođe do ovakvog scenarija, a sve ukazuje da se ka tome ide, to će značiti značajan pad ukupne privredne aktivnosti i veliki rast nezaposlenosti. Ovo će prvo biti vidljivo van Beograda i Novog Sada (u kojima za sada nema osetnijeg pada građevinskog sektora), ali će se neminovno proširiti i na ova dva glavna ekonomska centra.

U praktičnom smislu to znači da će hiljade ljudi koji sada rade kao zidari, tesari, keramičari, električari ili pomoćni radnici na građevini ostati bez posla. Isto tako, padom građevinskog sektora pada i transport i prodaja građevinskog materijala, smanjuje se proizvodnja i kupovina nameštaja i još mnogo stvari koje su međusobom povezane."

Da li cemo konacno videti kraj investitorske ekonomije?

Mikie

Higher intermediate

- Učlanjen(a)

- 26.08.2019.

- Poruke

- 1.828

- Pohvaljen

- 3.862

cena RE po pravilu kasni za tržištima, i do 18 meseci... kada krene drugi giga talas inflacije, kreće ozbiljnije dizanje koje će izazvati jaku recesiju...nekretnine nemaju gde...dok god je jako tržište rada, ljudi će plaćati rate bankama, kada puknu investicije, odoše i radna mesta i pocinje da pada kula od karata.

PetarPetrovic

Intermediate

- Učlanjen(a)

- 01.07.2018.

- Poruke

- 464

- Pohvaljen

- 1.046

Sa 6$ na 173$.

Sa 6$ na 173$.Ljudi, postoji i berza kao vid ulaganja a ne samo stanovi!

PROŠIRITE VIDIKE

PetarPetrovic

Intermediate

- Učlanjen(a)

- 01.07.2018.

- Poruke

- 464

- Pohvaljen

- 1.046

Spremam seJel ulazes u berzu, u koje akcije si ulozio ?

PetarPetrovic

Intermediate

- Učlanjen(a)

- 01.07.2018.

- Poruke

- 464

- Pohvaljen

- 1.046

preko koje platforme?

TradingView — Track All Markets

Where the world charts, chats, and trades markets. We're a supercharged super-charting platform and social network for traders and investors. Free to sign up.

MC_

Professional

- Učlanjen(a)

- 14.11.2017.

- Poruke

- 11.791

- Pohvaljen

- 12.086

dragan

Professional

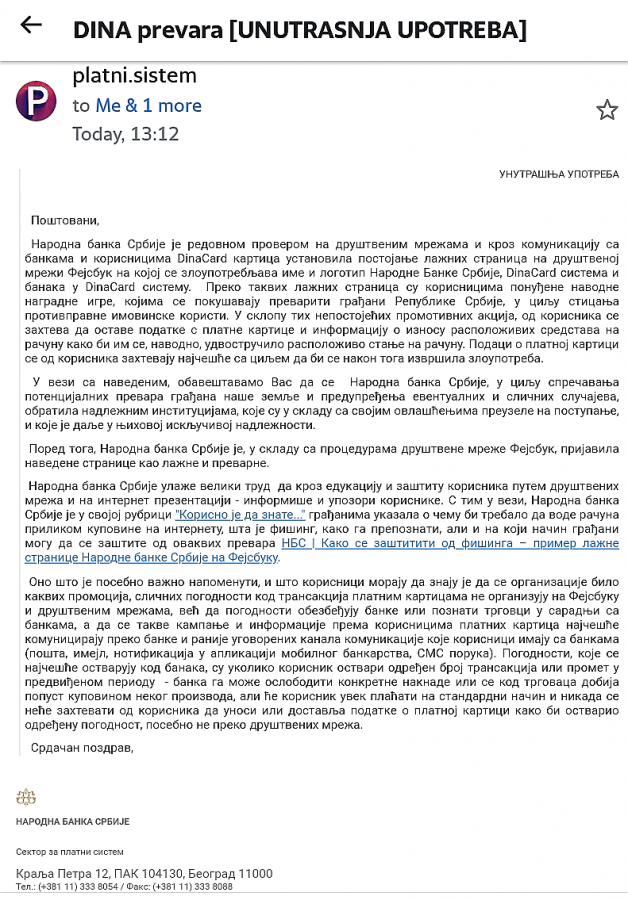

Prošle nedelje sam dobio FB poruku sa logom Narodne banke Srbije u kojoj mi nude uplatu na DINA račun onoliko novca koliko imam na tom računu.  . . Malo mi bilo sumnjivo, pa sam obavestio NBS i dobio ovaj mejl.

. . Malo mi bilo sumnjivo, pa sam obavestio NBS i dobio ovaj mejl.

Da li neko zaista misli da će izabrati recesiju pre inflacije? Da li ima i najmanje sumnje da će samo pustiti da se ne desi ništa?  Na ovaj ili onaj način, izabraće drugo, da li tako što će se dogovoriti ili će izmišljati vanredne mere, nije bitno. Nešto poput anti inflation bill (bahate li ironije

Na ovaj ili onaj način, izabraće drugo, da li tako što će se dogovoriti ili će izmišljati vanredne mere, nije bitno. Nešto poput anti inflation bill (bahate li ironije  ).

).

Sve se lepo dešava kako sam i predvideo! Realne kamate još uvek negativne, a biće prinuđeni da upumpavaju sve više i stimulišu. Lično mislim da će i kamate morati dole, ali nije bitno ni ako odu gore ako krene da divlja drugi talas inflacije...

Skaču samo nominalne varijable, kupovna moć se topi, share vlasnika postaje veći, još malo pa će sportisti biti potplaćeni. Prihod jedne PO utakmice pokriva ugovor Jokića za dve sezone.

Prihod jedne PO utakmice pokriva ugovor Jokića za dve sezone.  Da, čudno i nekako tužno zvuči u ovom sistemu vrednosti da 1 sportista ima platu kao 300 inženjera, tržišno je i potplaćen debelo...

Da, čudno i nekako tužno zvuči u ovom sistemu vrednosti da 1 sportista ima platu kao 300 inženjera, tržišno je i potplaćen debelo...

www.b92.net

www.b92.net

Sve se lepo dešava kako sam i predvideo! Realne kamate još uvek negativne, a biće prinuđeni da upumpavaju sve više i stimulišu. Lično mislim da će i kamate morati dole, ali nije bitno ni ako odu gore ako krene da divlja drugi talas inflacije...

Skaču samo nominalne varijable, kupovna moć se topi, share vlasnika postaje veći, još malo pa će sportisti biti potplaćeni.

U Denveru paprene cene karata za veliko finale - Vesti

Denver Nagetsi polako se zagrevaju za veliko NBA finale.

Mikie

Higher intermediate

- Učlanjen(a)

- 26.08.2019.

- Poruke

- 1.828

- Pohvaljen

- 3.862

scary

world stocks to 60/40 correlation equals .99

(Source: Man Group, BarclayHedge, Bloomberg; From 1 January 1987 where available, otherwise from 31 January 1995 until 31 March 2023.

Trend-following represented by Barclay BTOP50, World stocks represented by MSCI World Net Total Return Index, US stocks represented by S&P 500 Index (Local Currency Gross Dividend Total Return, World bonds represented by Barclays Capital Global Aggregate Bond Index Hedged USD, US bonds represented by Bloomberg/EFFAS Bond Indices US Govt 5-10 Yr TR monthly return, 60/40 represented by 60% World stocks + 40% World bonds, Commodities represented by Dow Jones-UBS Commodity Total Return Index, Dollar index represented by US Dollar Index Spot)

Da li je iko imao sumnje?

A i da nisu, smilili bi nešto da bajpasuju, poput pravljenja novčića od bilion dolara. U kakvom svetu živimo jbt...

www.b92.net

www.b92.net

A i da nisu, smilili bi nešto da bajpasuju, poput pravljenja novčića od bilion dolara. U kakvom svetu živimo jbt...

Izbegnuta finansijska katastrofa

Bender Rodriguez

Professional

- Učlanjen(a)

- 12.03.2017.

- Poruke

- 27.658

- Pohvaljen

- 64.564

Svetski ekonomski sistem u kome sudbina celog sveta sa 200 država i 7 milijardi ljudi de facto zavisi od odluke jedne zemlje na koji način će da falsifikuje svoje finansijsko stanje...

I koji je osuđen i dizajniran tako da puca svakih 15 godina, jedino "rešenje" se svodi na guranje pod tepih i prebacivanje tereta na sirotinju, svaki put sve jače i jače.

Pitam se šta bi naši preci imali da kažu kad bi videli dokle je sve otišlo i koliko se srozalo. Pogotovu npr ljudi poput Hakslija ili Orvela.

I koji je osuđen i dizajniran tako da puca svakih 15 godina, jedino "rešenje" se svodi na guranje pod tepih i prebacivanje tereta na sirotinju, svaki put sve jače i jače.

Pitam se šta bi naši preci imali da kažu kad bi videli dokle je sve otišlo i koliko se srozalo. Pogotovu npr ljudi poput Hakslija ili Orvela.

Poslednja izmena:

Mikie

Higher intermediate

- Učlanjen(a)

- 26.08.2019.

- Poruke

- 1.828

- Pohvaljen

- 3.862

limit down market

In normal times, the presence of institutional investors positively contributes to stock market efficiency and corporate value creation.1 But what is their role during crisis periods? In principle, the professional investment approach of institutional investors could help stabilize markets.2 However, Stein (2009) points out that when institutions enter the same trades and deleverage at the same time, they could exacerbate stock market crashes.

Do Institutional Investors Stabilize Equity Markets in Crisis Periods? Evidence from COVID-19

<div> During the COVID-19 stock market crash, U.S. stocks with higher institutional ownership (IO) <span>performed worse than those with lower IO. By studpapers.ssrn.com

vradovic

Expert

- Učlanjen(a)

- 31.10.2007.

- Poruke

- 6.140

- Pohvaljen

- 7.417

Preci bi bili zbunjeni kao i mi. Sa jedne strane tehnologija i kao nevidjeni progres na raznim poljima, medicina, udobnost zivota a sa druge strane jaz sve veci i veci i sve veca i veca oekivanja od ljudi da sve ekstremnije rade i sve vise i vise.Svetski ekonomski sistem u kome sudbina celog sveta sa 200 država i 7 milijardi ljudi de facto zavisi od odluke jedne zemlje na koji način će da falsifikuje svoje finansijsko stanje...

I koji je osuđen i dizajniran tako da puca svakih 15 godina, jedino "rešenje" se svodi na guranje pod tepih i prebacivanje tereta na sirotinju, svaki put sve jače i jače.

Pitam se šta bi naši preci imali da kažu kad bi videli dokle je sve otišlo i koliko se srozalo. Pogotovu npr ljudi poput Hakslija ili Orvela.

Preporučite: